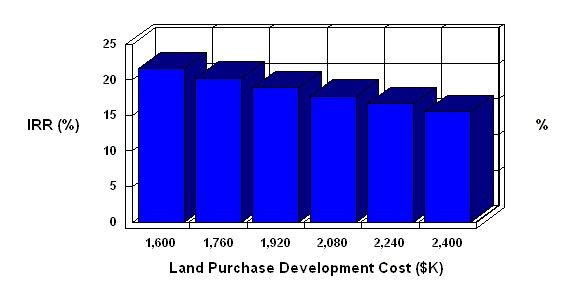

Land Purchase Development Cost

versus

Rate of Return After Tax

| Assumption | IRR |

| $1,600,000.00 | 21.6% |

| $1,760,000.00 | 20.2% |

| $1,920,000.00 | 18.9% |

| $2,080,000.00 | 17.7% |

| $2,240,000.00 | 16.6% |

| $2,400,000.00 | 15.5% |

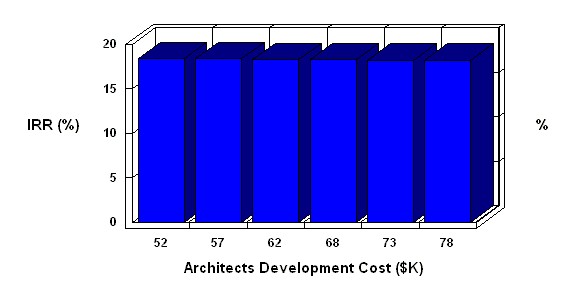

Architects Development Cost

versus

Rate of Return After Tax

| Assumption | IRR |

| $52,000.00 | 18.4% |

| $57,200.00 | 18.4% |

| $62,400.00 | 18.3% |

| $67,600.00 | 18.3% |

| $72,800.00 | 18.2% |

| $78,000.00 | 18.2% |

2nd-Fl Local New Months Vacant

versus

Rate of Return After Tax

| Assumption | IRR |

| None | 19.1% |

| 1.00 Months | 19.1% |

| 2.00 Months | 19.0% |

| 3.00 Months | 19.0% |

| 4.00 Months | 19.0% |

| 5.00 Months | 18.3% |

| 6.00 Months | 18.3% |

| 7.00 Months | 18.3% |

| 8.00 Months | 18.3% |

| 9.00 Months | 17.8% |

| 10.00 Months | 17.8% |

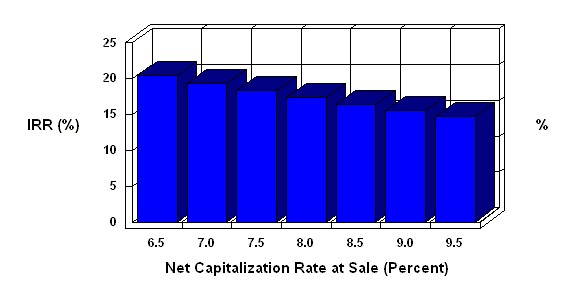

Net Capitalization Rate at Sale

versus

Rate of Return After Tax

| Assumption | IRR |

| 6.5% Net Cap Rate | 20.4% |

| 7% Net Cap Rate | 19.3% |

| 7.5% Net Cap Rate | 18.3% |

| 8% Net Cap Rate | 17.3% |

| 8.5% Net Cap Rate | 16.4% |

| 9% Net Cap Rate | 15.5% |

| 9.5% Net Cap Rate | 14.7% |