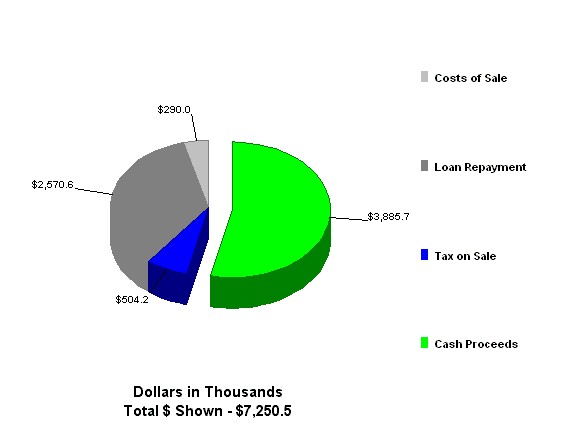

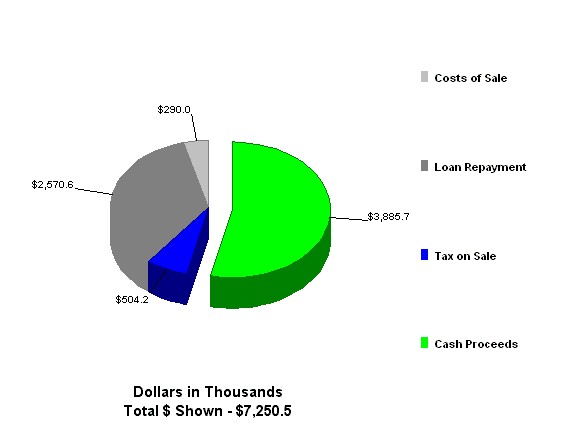

This report shows the results of a projected sale of the planEASe Office Development on 31 December 2019. The Sale Price of $7,250,545 is projected by using a Net Capitalization Rate of 7.5% on the Net Operating Income of $543,791 projected to be received during the next 12 months, according to the analysis assumptions.

| Analysis of Sale Proceeds | |||

| Sale Price (as discussed above) | $7,250,545 | ||

| - Costs of Sale (4%) | 290,022 | ||

| - Loan Balances | 2,570,607 | ||

| - Prepayment Penalties | 0 | ||

| Sale Proceeds Before Tax | $4,389,916 | ||

| Analysis of Capital Gain Results | |||

| Sale Price | $7,250,545 | ||

| - Capitalized Costs of Sale (100%) | 290,022 | ||

| Net Sale Price for Tax Purposes | $6,960,523 | ||

| Property Basis at Acquisition | $0 | ||

| + Capitalized Closing Costs (100%) | 0 | ||

| + Capital Additions | 4,682,134 | ||

| - Depreciation Taken | 649,691 | ||

| + Excess Depreciation Recaptured | 0 | ||

| Adjusted Basis at Sale | 4,032,443 | ||

| Capital Gain (or Loss) | $2,928,081 | ||

| - Suspended Passive Losses | 0 | ||

| Net Capital Gain (or Loss) | $2,928,081 | ||

| - Cost Recovery Recaptured | 649,691 | ||

| Adjusted Net Capital Gain (or Loss) | $2,278,390 | ||

| Cost Recovery Recapture Tax (@ 25%) | (162,423) | ||

| Tax on Adjusted Net Capital Gain (@ 15%) | (341,758) | ||

| Expenses Recognized at Sale | |||

| Expensed Costs of Sale | 0 | ||

| + Accrued Loan Interest | 0 | ||

| + Unamortized Points | 0 | ||

| + Prepayment Penalties | 0 | ||

| - Excess Depreciation Recaptured | 0 | ||

| Total Expenses Recognized at Sale | 0 | ||

| Tax Savings Due to Sale Expenses (@ 35%) | 0 | ||

| Net Taxable Income | $2,928,081 | ||

| After Tax Cash Proceeds of Sale | $3,885,735 |