Back to Installment Sale Index - planEASe Home Page

This report shows the detail of the major elements of the Installment Sale used to make the Installment Sale Projection.

Sale Proceeds Before Tax is detailed in the Source of Acquisition Funds area at the top of the report. This amount ties exactly to the Cash Flow Before Tax at Sale in the Installment Sale Projection.

The Calculation of Capital Gain area shows the total amount of Cost Recovery Recapture and Net Capital Gain allocated to the years in the Installment Sale Projection.

The sum of Excess of Mortgage over Basis and the Down Payment shown here constitute the Principal Received at Sale in the Installment Sale Projection.

If Tax is being paid pro rata (see Tax Payment Treatment), the Profit Ratio and Recovery Ratio computed here are used in the Installment Sale Projection to compute the Recovery Recapture and Net Capital Gain amounts for each time period in the Installment Sale Projection.

If Recapture is paid first (see Tax Payment Treatment), the Gross Profit Ratio computed here is used in the Installment Sale Projection to compute the Recovery Recapture and Net Capital Gain amounts for each time period in the Installment Sale Projection.

| Source of Acquisition Funds | |

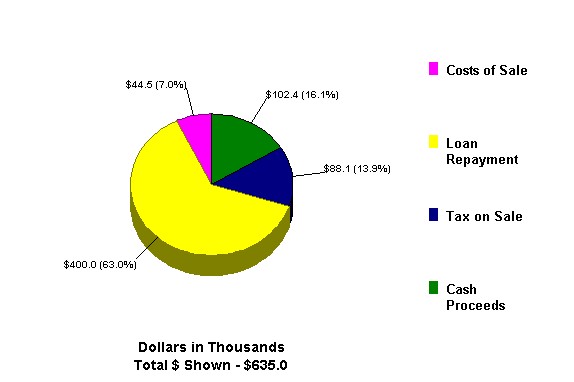

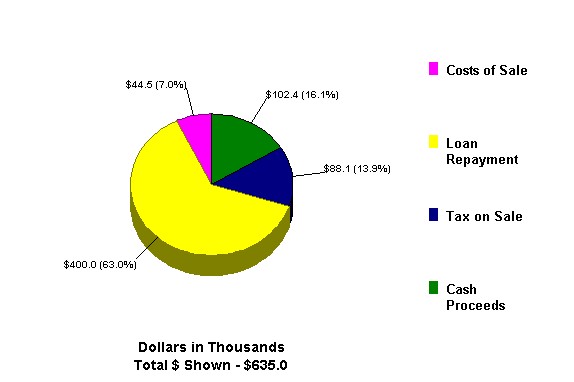

| Sale Price | $635,000 |

| - Existing Loans Assumed | 0 |

| - Existing Loans Paid Off | 0 |

| - Loan Prepayment Penalties | 0 |

| - Purchase Money Note | 515,000 |

| Down Payment | $120,000 |

| - Costs of Sale (7%) | 44,450 |

| Sale Proceeds Before Tax | $75,550 |

| Calculation of Capital Gain | |

| Sale Price | $635,000 |

| - Capitalized Costs of Sale (100%) | 44,450 |

| Net Sale Price for Tax Purposes | $590,550 |

| - Adjusted Basis at Sale | 225,000 |

| - Excess Cost Recovery Recapture | 0 |

| Capital Gain (or Loss) | $365,550 |

| - Suspended Passive Losses | 0 |

| Net Capital Gain (or Loss) | $365,550 |

| - Cost Recovery Recaptured | 300,000 |

| Adjusted Net Capital Gain (or Loss) | $65,550 |

| Cost Recovery Recapture Tax (@ 25%) | (75,000) |

| Tax on Adjusted Net Capital Gain (@ 20%) | (13,110) |

| Calculation of Excess of Mortgage over Basis | |

| Existing Loans Assumed | $0 |

| - Adjusted Basis at Sale | 225,000 |

| - Capitalized Costs of Sale (100%) | 44,450 |

| - Excess Cost Recovery Recapture | 0 |

| Excess of Mortgage over Basis (minimum 0) | $0 |

| Calculation of Contract Price and Profit/Recovery Ratios | |

| Sale Price | $635,000 |

| + Excess of Mortgage over Basis | 0 |

| - Existing Loans Assumed/Wrapped | 400,000 |

| - Existing Loans Paid Off | 0 |

| Contract Price | $235,000 |

| Gross Profit Ratio (Net Capital Gain / Contract Price) | 1.555532 |

The data and calculations presented herein, while not guaranteed,

have been obtained from sources we believe to be reliable.

Produced by planEASe from Analytic Associates (800) 959-3273

The data and calculations presented herein, while not guaranteed,

have been obtained from sources we believe to be reliable.

Produced by planEASe from Analytic Associates (800) 959-3273